Some of us have been ourselves, others just know someone who has: losing someone who is a beneficiary of inheritance. It is usually inheritance money from a parent and in more tragic events, both parents. As we can all imagine, this is a very stressful time for any individual. Losing someone close to home is a tragic experience and having to deal with the stress of what to do and how to best use one’s inheritance money is an extra worry. It comes as no surprise that a couple of months down the line, we learn that our “lucky” friend is broke, all their inherited funds have run out, and they are now not only mourning a loss, but are left cashless too.

All kinds of rumours can kick up after this happens and it usually boils down to one conclusion: lack of financial education results in fund mismanagement on the part of the beneficiary.

We don’t always acquire financial management know-how from school and thus we need to educate ourselves and learn about different ways to spend our money wisely. If you were in the beneficiary’s shoes, how would you have spent your inherited money differently?

Let’s delve into tried and tested ways to invest your inheritance money.

First off, you need to look at your personal financial situation: your goals and needs for the future!

It is extremely important to answer questions like these when planning your financial future:

Do you need to cater for someone else’s needs, maybe your siblings?

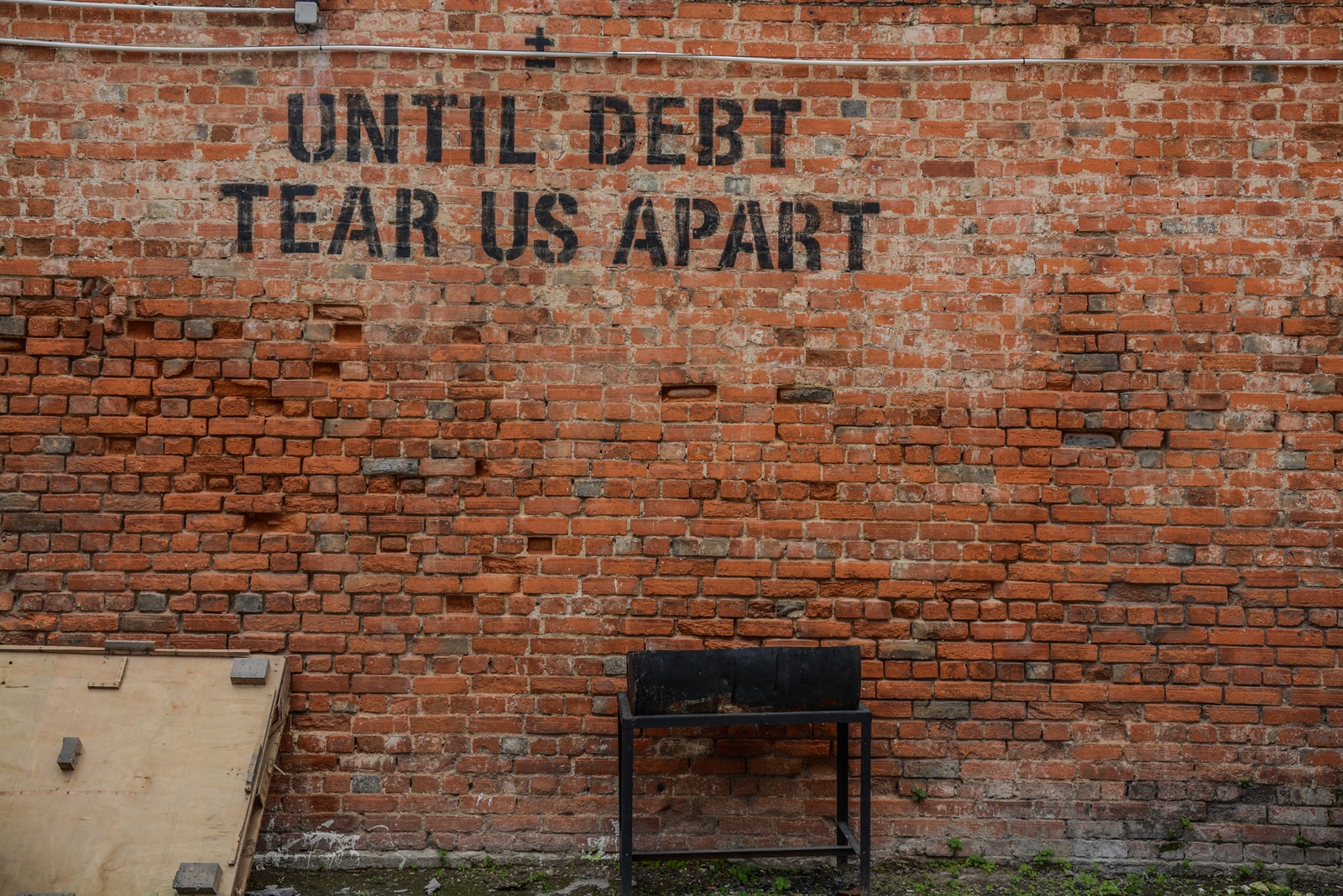

Do you have debts, maybe a car, house, credit-cards, store accounts?

Do you need to save for an emergency or school-fees?

Once you’ve gathered all your information, made all the calculations and it’s time to invest your leftover money, try to get professional guidance from a financial advisor or financial planner. Remember, it’s important to make a wise investment!

One of the biggest decisions you’re going to have to make is what sort of account you’re going to invest your money (inherited or earned) into. In March 2015 the South African Revenue Service (SARS) launched Tax Free Investment accounts (TFIA’s). This is a must-have for youth because they are 100% tax-free accounts (no tax on capital gains or any interest earned on your money.) They have an annual contribution limit of R30 000 and a lifetime limit of R500 000 per person. Various licensed banks, long-term insurers and service providers offer TFIA’s.

Visit your nearest bank to enquire. You can also choose from different types of TFIA’s to invest your money such as:

- Fixed deposits

- Unit trusts (collective investment schemes)

- Retail savings bonds (by the National Government)

- Certain endowment policies issued by long-term insurers

- Linked investment products

- Exchange traded funds (ETFs) that are classified as collective investment schemes

Once you have your TFIA set up, your service provider will send SARS investment information twice a year and send you (the taxpayer) a tax free investment certificate (IT3) annually. Like anything that involves large amounts of money,it is imperative to get the right guidance from a professional, because there are countless scamsters out there.

Investing your inheritance after using a portion of it to pay for your priorities has to be the greatest way to go about creating a financially stable and care-free future for you and your family.